Top Stories

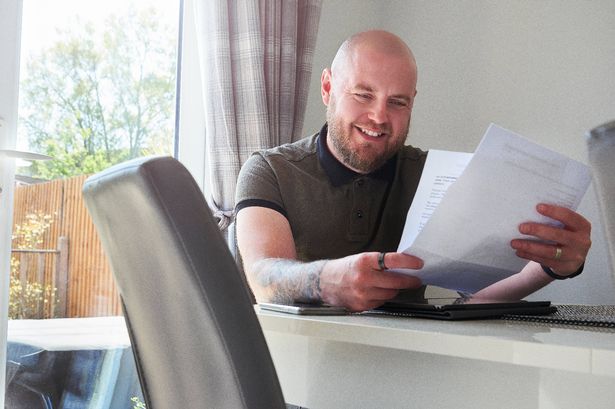

Universal Credit Claimants Can Access £1,200 Bonus Until 2027

The Department for Work and Pensions (DWP) has revealed that approximately 8 million individuals in the UK are currently claiming Universal Credit. Many of these working claimants may be unaware that they could be eligible for a significant bonus of up to £1,200 through the government’s Help to Save scheme, which has been extended until April 2027.

The recent changes to the scheme mean that about 3 million Universal Credit claimants can now take advantage of this initiative designed to enhance their financial stability. Since its launch in 2018, Help to Save has distributed millions in bonuses to over 500,000 participants. Notably, 93 percent of those enrolled have consistently deposited the maximum of £50 each month into their accounts, showcasing the scheme’s popularity and effectiveness.

Understanding the Help to Save Scheme

Help to Save provides a straightforward way for eligible individuals to save money while earning bonuses. Participants can deposit between £1 and £50 each month, receiving a 50 percent bonus on their savings. Bonuses are awarded at the end of the second and fourth years of account activity, making it an attractive option for those looking to build their financial future.

For example, if a participant saves the maximum amount of £2,400 over four years by contributing £50 each month, they will earn a total bonus of £1,200. This bonus is paid out at the end of the specified periods, providing a tangible incentive to save.

Individuals can manage their Help to Save accounts easily through the GOV.UK website or the HMRC app. There is no immediate requirement to deposit funds when opening an account, making it accessible for those who may currently have constraints on their savings ability.

How the Bonuses Work

To qualify for bonuses, participants must follow the guidelines set by the scheme. There is flexibility in how often deposits can be made, with no obligation to contribute each month. However, the total contributions cannot exceed £50 per month. Withdrawals can be made at any time, but participants should be cautious as this could affect their bonus earnings.

For instance, if an individual deposits £50 monthly for the first two years, accumulating £1,200, they will receive a bonus of £600 at the end of the second year. If they continue saving at the same rate, they will receive another bonus of £600 at the end of the fourth year, potentially allowing them to earn a total of £1,200 in bonuses while holding onto their savings.

After four years, the Help to Save account will close, and participants will not be able to reopen it or start a new account. It is crucial for individuals to consider their saving strategies carefully to maximize their benefits before this deadline.

Eligibility and Application Process

To open a Help to Save account, individuals must be claiming Universal Credit and have a take-home pay of at least £1 in their most recent monthly assessment period. This includes both individual and joint claims, allowing couples to maintain separate accounts if they wish.

Eligibility extends to those living in the UK, and even individuals residing overseas may apply under certain conditions. Continuing to use the Help to Save account will not affect current benefit payments, including Tax Credits or Universal Credit.

For detailed information and to initiate the application process, individuals are encouraged to visit the GOV.UK website.

This extension of the Help to Save scheme offers a crucial opportunity for many Universal Credit claimants to strengthen their financial resilience through effective saving strategies. By taking advantage of this scheme, participants can significantly enhance their savings and secure a brighter financial future.

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Entertainment4 months ago

Entertainment4 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment3 months ago

Entertainment3 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend

-

Entertainment6 days ago

Entertainment6 days agoCoronation Street Fans React as Todd Faces Heartbreaking Choice

-

Entertainment3 months ago

Entertainment3 months agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment4 months ago

Entertainment4 months agoSpeculation Surrounds Home and Away as Cast Departures Mount