Business

River Island Launches Closing Down Sale Amid Store Closures

River Island, a prominent British fashion retailer, has initiated a closing down sale at its store located in the Southside shopping centre in Wandsworth, London. The discount of 30% is set to help clear remaining stock before the store’s permanent closure, which is part of a broader restructuring plan affecting locations across the UK. This decision reflects the challenges faced by the brand as it grapples with a shifting retail landscape and increasing competition from online shopping.

The closure of the Wandsworth branch will be disheartening for local customers, who have previously praised the store for its selection and customer service. One shopper remarked on the positive experiences they’ve had, stating, “Every time I come to this store, I always have a good experience. The staff is so friendly and helpful. It makes a difference.”

Broader Impact on Retail Sector

River Island is one of multiple retailers facing significant challenges, with the company having announced plans to close a total of 33 stores in January 2024. This move is part of a strategy to stabilize the business, as the brand reported a pre-tax loss of £32.3 million last year, alongside a 15% decline in turnover, which fell to £578.1 million.

In addition to the Wandsworth location, the chain has also designated other branches for closure, including one in Edinburgh set to shut on September 5, 2024. The company is also negotiating with landlords of 71 stores for rent reductions to alleviate financial pressure during this turbulent period.

The retail landscape in the UK continues to be fraught with difficulties. Many brands are struggling with low consumer spending combined with rising operational costs. Similar challenges have led to significant changes at other retailers, such as New Look, which has closed a dozen sites this year and is reportedly exploring strategic options that could include a sale.

Wider Retail Challenges and Predictions

The British Retail Consortium recently highlighted the potential impact of rising costs on the retail sector, predicting that the Treasury’s increase in employer National Insurance Contributions (NICs) could cost the industry approximately £2.3 billion. A study conducted by the British Chambers of Commerce revealed that over half of surveyed companies anticipate raising prices in the upcoming months, with 55% expecting increases compared to 39% in a similar survey conducted late last year.

The Centre for Retail Research (CRR) has projected that around 17,350 retail sites could close this year, following a challenging 2024 in which 13,000 shops shuttered permanently, marking a 28% increase from the previous year. Professor Joshua Bamfield, director of the CRR, expressed concern about future trends, stating, “The results for 2024 show that… they are still disconcerting, with worse set to come in 2025.” He further predicted that the sector could face the loss of up to 202,000 jobs as operational costs continue to rise.

As River Island and other retailers navigate these turbulent waters, the future of many high street brands remains uncertain, with closures likely to impact local economies and employment opportunities across the UK.

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment2 weeks ago

Entertainment2 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment4 weeks ago

Entertainment4 weeks agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

Science1 month ago

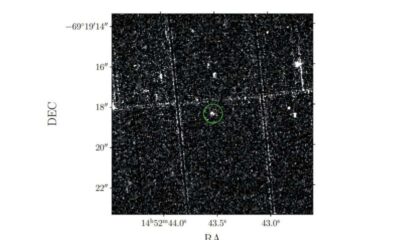

Science1 month agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Entertainment4 weeks ago

Entertainment4 weeks agoLas Culturistas Awards Shine with Iconic Moments and Star Power

-

Entertainment3 weeks ago

Entertainment3 weeks agoTurmoil in Emmerdale: Charity Dingle and Mack’s Relationship at Risk

-

Lifestyle1 month ago

Lifestyle1 month agoTesco Slashes Prices on Viral Dresses in Summer Clearance Sale

-

Politics2 months ago

Politics2 months agoPlane Crash at Southend Airport Claims Four Lives After Takeoff