Top Stories

Nigerian Officials Dismiss Immediate Plans for 5% Fuel Tax

The Nigerian government has confirmed that there are no immediate plans to implement the proposed 5% fuel tax. During a press conference in Abuja on October 3, 2023, Minister of Finance and Coordinating Minister of the Economy, Wale Edun, alongside Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, clarified that the contentious tax surcharge would not take effect on January 1, 2026, as previously speculated.

Edun highlighted the ongoing economic challenges faced by Nigerians, acknowledging the high cost of living. In response to growing concerns, the Trade Union Congress of Nigeria (TUC) issued a 14-day ultimatum to the federal government, demanding the withdrawal of any plans for a tax surcharge, warning of a potential total economic shutdown if their demands are not met.

While the Tax Administration Act will come into effect on January 1, 2026, Edun emphasized that the 5% fuel surcharge, referenced within the Act, does not activate automatically. He explained that a formal process is required before such a charge can be implemented, which includes a commencement order from the Minister of Finance, to be published in an official gazette. “As of today, no order has been issued, none is being prepared, and there is no immediate plan to implement any surcharge,” Edun stated.

The minister further clarified that the surcharge has its origins in the Federal Road Maintenance Agency (FERMA) Act of 2007, and its inclusion in the 2025 Act was aimed at consolidating existing laws to improve clarity and compliance, rather than introducing a new tax. He noted that the initial proposal stipulated that 40% of the proceeds would benefit FERMA, while 60% would support state road management agencies.

Edun reiterated the government’s commitment to enhancing tax governance and blocking revenue leakages. He asserted, “We don’t want to worsen the burden on Nigerians. Our priority is to strengthen tax governance, block revenue leakages, improve efficiency, rather than just levy new taxes.”

In a separate interview, Taiwo Oyedele reinforced that the proposed surcharge is intended to address Nigeria’s deteriorating road infrastructure rather than impose additional financial strain on households. He clarified that without the gazetting of the tax, it cannot take effect, stating, “Nobody will just spontaneously introduce the tax and create problems for the system.”

Oyedele pointed out that the surcharge, initially proposed by a previous government, had been rejected by the current administration for direct collection by FERMA. He contended that the TUC’s threat of strike action is misguided, as the surcharge has not yet been enacted. “The TUC should have complained and protested when this was introduced in 2007,” he remarked.

Concerns about inflation also emerged during the discussions. Oyedele acknowledged that the poor state of Nigeria’s roads contributes significantly to logistics costs, with approximately 200,000 kilometers of roads, of which only about 60,000 are paved. He emphasized that addressing road infrastructure is crucial for reducing the overall cost of goods and transportation.

He argued that the removal of fuel subsidies has created some fiscal space, but acknowledged that revenue from subsidies alone will not suffice to close the infrastructure gap. Oyedele assured citizens that the surcharge would be implemented cautiously, with the aim of minimizing its impact on inflation and vulnerable populations. “Some strategies for this surcharge could be to time it at a period when there is an appreciation in the value of the currency,” he explained.

The proposed fuel surcharge seeks to create a dedicated fund for road maintenance, ensuring that the funds raised are specifically allocated to improving Nigeria’s critical infrastructure. Oyedele highlighted the success of the Road Infrastructure Tax Credit Scheme, which allows private companies to invest in road construction in return for tax credits, suggesting that similar arrangements could be beneficial in utilizing the surcharge effectively.

In conclusion, the Nigerian government has reiterated its commitment to managing tax reforms responsibly, prioritizing economic stability, and addressing infrastructural needs without imposing undue burdens on citizens.

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 weeks ago

Entertainment3 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment1 week ago

Entertainment1 week agoITV’s I Fought the Law: Unraveling the True Story Behind the Drama

-

Entertainment1 month ago

Entertainment1 month agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

Science1 month ago

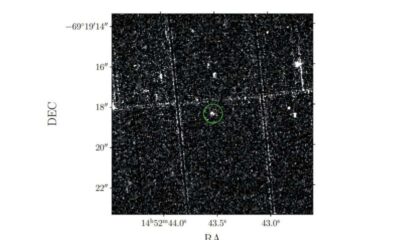

Science1 month agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Entertainment1 month ago

Entertainment1 month agoLas Culturistas Awards Shine with Iconic Moments and Star Power

-

Entertainment1 week ago

Entertainment1 week agoKatie Price Celebrates Surprise Number One Hit with Family Support