Business

Wise Shareholders Approve US Listing Amid Controversial Vote

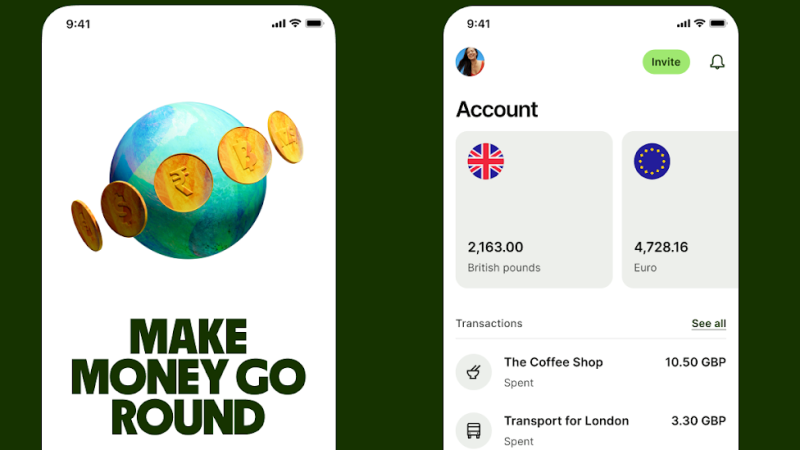

Shareholders of Wise have overwhelmingly approved a plan to move the company’s listing from London to New York, despite significant controversy surrounding the conditions of the vote. The proposal received strong backing, with nearly 91% of class A shares and 84.5% of class B shares voting in favor of the special resolution.

Controversial Dual-Class Share Structure

The move to relocate Wise’s listing is accompanied by the contentious decision to extend the company’s dual-class share structure until 2036. When Wise went public in London in 2021, it implemented this structure to ensure control remained in the hands of a small group of investors. Originally, this arrangement was set to expire in 2026, but the recent vote tied its extension to the transition to a New York listing.

Co-founder Taavet Hinrikus, who holds over 5% of the company through his investment vehicle, Skaala Investments OÜ, criticized the “all or nothing” nature of the vote. He argued that the proposal forced shareholders to choose between supporting the listing move and maintaining the dual-class structure. This sentiment was echoed by Pirc, a proxy advisory firm that lobbied against the resolution.

Management’s Response

Despite the backlash, Wise’s management expressed satisfaction with the outcome. David Wells, chair of Wise, stated, “We’re pleased that our owners have overwhelmingly approved the proposal, giving us a strong mandate to proceed.” This approval marks a significant step for Wise as it seeks to enhance its market presence in the United States.

The decision to relocate the listing is seen as a strategy to tap into a larger investor base and increase visibility in one of the world’s leading financial markets. As Wise prepares for this transition, the focus will be on navigating the complexities associated with the dual-class share structure while ensuring shareholder interests remain a priority.

In summary, Wise’s shareholder vote reflects a decisive move towards a New York listing, albeit with ongoing debates over governance structures. The next steps for Wise will involve implementing the transition and addressing the concerns raised during this voting process.

-

World2 days ago

World2 days agoCoronation Street’s Shocking Murder Twist Reveals Family Secrets

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 weeks ago

Entertainment3 weeks agoCoronation Street Fans React as Todd Faces Heartbreaking Choice

-

World3 weeks ago

World3 weeks agoBailey Announces Heartbreaking Split from Rebecca After Reunion

-

Entertainment5 days ago

Entertainment5 days agoTwo Stars Evicted from I’m A Celebrity Just Days Before Finale

-

World5 days ago

World5 days agoKevin Sinfield Exceeds Fundraising Goal Ahead of Final Marathons

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science2 months ago

Science2 months agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery