Business

UK Faces Economic Crisis as Government Borrowing Costs Surge

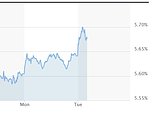

The United Kingdom is confronting significant economic challenges as government borrowing costs have surged to a 27-year high. On September 2, 2025, yields on 30-year UK bonds, known as gilts, rose to just below 5.7 percent, the highest level since 1998. This spike follows a government reshuffle perceived to have sidelined key economic figure Rachel Reeves, raising concerns about the Labour Party’s fiscal management.

The escalating yields indicate that investors are demanding higher returns to lend to the UK government, complicating the Chancellor’s budgeting efforts. Analysts warn that there could be a fiscal gap of up to £50 billion, prompting speculation that additional bonds may be necessary to finance new borrowing. The market is also reacting to rising inflation, which has reached an 18-month peak, with expectations that it could approach 4 percent.

Adding to the tense economic atmosphere, the tax burden is projected to hit a record high as Labour strives to manage its spending commitments. The reshuffle, which brought left-leaning economic advisers closer to Keir Starmer, has intensified fears of potential tax increases. Conservative frontbencher Andrew Griffith remarked, “Labour are leading us towards economic oblivion,” while fellow Conservative MP Tom Tugendhat warned, “We’re broke. And if we don’t decide how to tighten our belts, it will be decided for us by those who refuse to lend us the money.”

Typically, an increase in bond yields suggests that markets anticipate higher interest rates and might coincide with a stronger currency. However, the British pound has weakened, dropping nearly two cents against the US dollar to below $1.34 and losing ground against the euro, now trading at less than €1.15. This decline reflects a loss of confidence in the government’s economic strategy.

Market Reactions and Expert Opinions

The UK stock market is also showing signs of distress, with the FTSE 100 index on track for its fifth decline in six days. Neil Wilson, an investor strategist at Saxo Markets, commented, “Thirty-year yields at their highest in almost three decades is not a good look for the Labour government and underscores that there is little fiscal or economic credibility left.”

Concerns are not limited to the UK; bond yields across Europe are also rising, particularly in France, where the government faces imminent instability. Nonetheless, the UK’s borrowing costs remain markedly higher than those of other advanced economies, with the gap widening. Wilson added, “The moron premium is definitely evident as the spread between thirty-year gilt yields and bond yields of peers widened to a record.”

Economic analysts are particularly wary as the Autumn Budget approaches. Jane Foley, head of FX strategy at Rabobank, stated, “The UK is going to be vulnerable to fiscal risks as the Autumn budget approaches, which is likely to remain a headwind for sterling.”

As the Labour government prepares for the upcoming budget, Rachel Reeves is anticipated to face mounting pressure to increase spending from within her party, all while managing an economy that is slowing down and accumulating higher interest rates on its debt.

The current economic landscape presents a complex challenge for the UK government, and with the stakes high, the road ahead may prove to be fraught with difficulty.

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Health4 months ago

Health4 months agoCarol Vorderman Reflects on Health Scare and Family Support

-

Entertainment4 months ago

Entertainment4 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

World2 weeks ago

World2 weeks agoBailey Announces Heartbreaking Split from Rebecca After Reunion

-

Entertainment3 months ago

Entertainment3 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend

-

Entertainment2 weeks ago

Entertainment2 weeks agoCoronation Street Fans React as Todd Faces Heartbreaking Choice