Top Stories

Determine Your Stocks and Shares ISA Needs for a Comfortable Retirement

Individuals aiming for an early retirement should consider the benefits of a Stocks and Shares ISA. Unlike traditional pensions, there is no minimum age for withdrawing income from these accounts. According to the Pensions and Lifetime Savings Association, a single person needs approximately £31,700 annually to retire comfortably. This raises the question: how much must one invest to achieve this level of income?

Investment and tax implications vary for each individual, and readers should conduct thorough research and seek professional advice before making investment decisions. The information presented here is intended for informational purposes only and does not constitute tax advice.

Understanding Passive Income through Dividends

One of the primary benefits of a Stocks and Shares ISA is the potential for generating passive income, primarily through dividends. When companies distribute part of their profits to shareholders, this cash can contribute significantly to retirement income. Currently, the FTSE 100 has a dividend yield of 3.3%. To generate an annual income of £31,700 from an investment in a fund tracking the FTSE 100, an individual would need to invest approximately £960,606. However, inflation is likely to increase this figure for future retirees.

Investment opportunities vary significantly among stocks. For instance, shares in Legal & General currently offer a yield of 9.16%, meaning that a comfortable retirement could be achieved with an investment of around £346,069. High dividend yields can signal potential risks, as they may suggest that investors have concerns about future payment stability.

On the other hand, companies like Diploma present a different scenario. While their future growth prospects appear strong, their current yield of only 1.12% implies that to generate £31,700 annually, an investment exceeding £2.83 million would be necessary.

Identifying Growth alongside Dividends

Some companies successfully balance growth and dividend returns. A prime example is Games Workshop, known for its Warhammer franchise. Over the past decade, the company has returned around 80% of its net income to investors through dividends while still achieving an average revenue growth of 18% per year. This achievement places Games Workshop among the few companies that can provide both returns and growth opportunities.

Despite its success, Games Workshop operates in a sector that faces risks from fluctuating consumer spending. As household budgets tighten, companies that depend on discretionary spending may encounter challenges. Nonetheless, many investors maintain a positive outlook, anticipating that the overall trajectory for such companies will remain upward over time.

With a current dividend yield of 2.41%, an individual aiming for an annual income of £31,700 from Games Workshop would need to invest approximately £1.32 million. While this represents a significant investment in a single stock, it highlights the financial commitment required for a comfortable retirement.

Investing in a Stocks and Shares ISA offers the advantage of tax-free dividends, which can lead to substantial savings over time. However, reaching the financial goal necessary for a comfortable retirement remains a long-term objective for many. Inflation is likely to raise the target figure further in the future, making it essential for investors to carefully choose companies with strong growth potential.

As individuals plan for their retirement, it is crucial to consider investments that not only provide immediate returns but also have the potential to grow faster than inflation. Companies like Games Workshop, with unique products and solid market positions, are worth serious consideration as part of a diversified investment strategy.

For those interested in exploring specific stock recommendations, Mark Rogers, an investment expert, suggests focusing on standout stocks that could provide significant returns. The landscape for Stocks and Shares ISAs is evolving, and investors should remain informed about market trends and opportunities as they approach retirement.

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 weeks ago

Entertainment3 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment1 week ago

Entertainment1 week agoITV’s I Fought the Law: Unraveling the True Story Behind the Drama

-

Entertainment1 month ago

Entertainment1 month agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Entertainment6 days ago

Entertainment6 days agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore

-

Science1 month ago

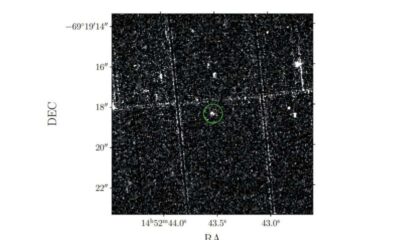

Science1 month agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Entertainment1 month ago

Entertainment1 month agoLas Culturistas Awards Shine with Iconic Moments and Star Power