Business

Plan for Early Retirement: Stocks and Shares ISA Insights for 2025

For individuals aiming for an early retirement, investing in a Stocks and Shares ISA may present an attractive option. Unlike traditional pensions, there is no minimum age for accessing funds, allowing for greater flexibility in financial planning. According to the Pensions and Lifetime Savings Association, a single person requires approximately £31,700 annually to retire comfortably. This raises the question: how much should one invest to achieve that level of income?

It is essential to acknowledge that tax treatment varies significantly based on personal circumstances and is subject to future changes. The information provided here is for informational purposes only and does not constitute tax advice. Readers are encouraged to conduct their own research and seek professional guidance before making investment decisions.

Generating Passive Income through Dividends

One of the primary methods to earn passive income from a Stocks and Shares ISA is through dividends. These are payments made by companies to shareholders from their profits. Currently, the FTSE 100 has a dividend yield of 3.3%. Based on this rate, an investment of approximately £960,606 would be necessary to generate an annual income of £31,700. However, it is important to consider the impact of inflation, which will likely increase the required investment for future retirees.

Not all dividend stocks are created equal. For instance, shares in Legal & General offer a high yield of 9.16%, meaning an investment of around £346,069 would suffice to achieve the desired income. Nevertheless, high yields can sometimes signal investor concerns about the sustainability of such payouts.

On the contrary, companies like Diploma project strong future growth but feature a lower yield of 1.12%. This would necessitate a staggering investment of over £2.83 million to secure the same income. The best-performing companies often manage to balance growth with adequate returns to shareholders, making them highly sought after.

Identifying Growth and Dividend Opportunities

A prime example of a company that excels in both growth and dividends is Games Workshop (LSE:GAW). Over the past decade, the firm has returned about 80% of its net income to shareholders as dividends while maintaining impressive revenue growth. The company has averaged an annual revenue increase of 18%, thanks to its well-established Warhammer franchise, which incurs minimal maintenance costs.

Despite the potential for market fluctuations, Games Workshop represents a significant investment opportunity, particularly for those looking to retire early. The company’s dividend yield stands at 2.41%, requiring an investment of approximately £1.32 million to generate the desired £31,700 annually. While this is a considerable sum, it provides a framework for understanding the financial commitments necessary for a comfortable retirement.

Investments held within a Stocks and Shares ISA are not subject to dividend tax, providing a notable financial advantage for retirees aiming to maximize their income. With inflation likely to impact future income requirements, it is crucial for investors to remain vigilant and adjust their strategies accordingly.

As financial landscapes evolve, some companies with unique products and strong market positions may offer the potential for faster growth than inflation. Games Workshop exemplifies such a company, making it a valuable consideration for investors planning for retirement.

In conclusion, for those contemplating early retirement, a Stocks and Shares ISA can be a viable investment vehicle. Understanding the necessary investment levels and potential income sources is vital for achieving financial independence by March 15, 2025. As always, consultation with financial professionals is recommended to navigate the complexities of investing and tax implications effectively.

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 weeks ago

Entertainment3 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment1 week ago

Entertainment1 week agoITV’s I Fought the Law: Unraveling the True Story Behind the Drama

-

Entertainment1 month ago

Entertainment1 month agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Entertainment6 days ago

Entertainment6 days agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

Science1 month ago

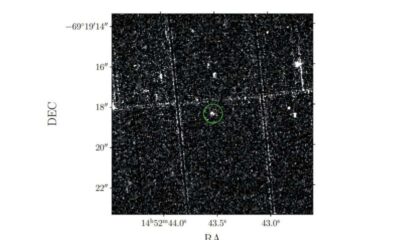

Science1 month agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Entertainment1 month ago

Entertainment1 month agoLas Culturistas Awards Shine with Iconic Moments and Star Power