Business

Uncovering Universal Credit Myths That May Cost You Money

Universal Credit, the most widely claimed benefit in the UK, currently serves approximately 7.4 million claimants. Yet, estimates indicate that an additional 1.2 million households may be eligible but are not claiming their benefits from the Department for Work and Pensions (DWP). According to an analysis by Policy in Practice, around £7.5 billion in Universal Credit remains unclaimed, largely due to misconceptions about eligibility and the value of available support.

Many individuals mistakenly believe that Universal Credit is solely for those who are completely unemployed. In reality, the program is designed to assist people with low incomes. Importantly, benefits do not automatically cease when a claimant starts working or increases their hours. While payments may decrease if earnings exceed a designated work allowance, this threshold typically ranges between £411 and £684 per month, depending on personal circumstances. Once this allowance is surpassed, a tapering system is applied, reducing Universal Credit payments by 55 pence for every additional pound earned.

Official government guidance clarifies, “If you or your partner are working, how much Universal Credit you get will depend on how much you earn. There’s no limit to how many hours you can work and still get Universal Credit.” This means that many individuals and families could be missing out on significant financial support simply due to inaccurate beliefs about the program.

Another common misconception involves the relationship between savings and eligibility. Many people are aware that if their savings exceed £16,000, they will not qualify for Universal Credit. However, the reality is more nuanced. The lower limit for savings is £6,000. For every £250 above this threshold, the monthly benefit is reduced by £4.35. For example, if someone has £6,400 in savings, their Universal Credit payment will be decreased by a total of £8.70.

Understanding what constitutes savings or capital under DWP regulations is crucial. For Universal Credit assessment, savings include cash, savings accounts, property not occupied by the claimant, cryptocurrency, inheritance payments, and even funds belonging to others that are in the claimant’s name. A comprehensive list can be found on the official government website.

Applying for Universal Credit can often be a daunting and complex process, leading many eligible individuals to delay or avoid applying altogether. To assist with this, Citizens Advice offers a Help to Claim service, providing free support from trained advisors. These professionals guide applicants through the claiming process, help prepare for jobcentre appointments, and ensure that all information shared is confidential.

Universal Credit can provide various forms of support tailored to individual circumstances. The minimum monthly standard allowance is currently £316.98, but claimants could receive significantly more if they have children, disabilities, or caregiving responsibilities. Additionally, successfully claiming Universal Credit may open the door to other assistance programs, such as the Warm Home Discount, Help to Save accounts, WaterSure scheme, social tariffs, and free school meals, each with its own eligibility criteria.

With substantial amounts of Universal Credit remaining unclaimed, addressing these misconceptions could lead to improved financial support for many families across the UK. By better informing the public about the true nature of Universal Credit and its eligibility requirements, more individuals may be empowered to access the benefits they rightfully deserve.

-

Entertainment6 days ago

Entertainment6 days agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment6 days ago

Entertainment6 days agoMarkiplier Addresses AI Controversy During Livestream Response

-

Politics4 weeks ago

Politics4 weeks agoPlane Crash at Southend Airport Claims Four Lives After Takeoff

-

Lifestyle1 week ago

Lifestyle1 week agoTesco Slashes Prices on Viral Dresses in Summer Clearance Sale

-

Top Stories4 weeks ago

Top Stories4 weeks agoAustralian Man Arrested for Alleged Damage to Stone of Destiny

-

Entertainment1 week ago

Entertainment1 week agoEmmerdale Characters Face Danger as Stabbing Shakes Village

-

Business4 weeks ago

Business4 weeks agoTrump’s “One Big Beautiful Bill” Faces Economic Scrutiny

-

Sports7 days ago

Sports7 days agoCommunity Pays Tribute as Footballer Aaron Moffett Dies at 38

-

Business4 weeks ago

Business4 weeks agoNew Study Links Economic Inequality to Lower Well-Being Globally

-

Sports4 weeks ago

Sports4 weeks agoSheffield United’s Young Talent Embraces Championship Opportunity

-

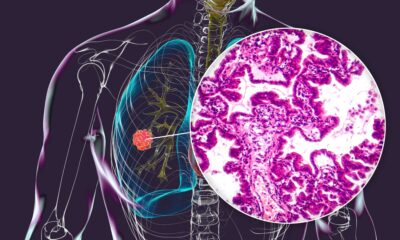

Health4 weeks ago

Health4 weeks agoAI Tool EAGLE Streamlines Lung Cancer Mutation Detection

-

Lifestyle4 weeks ago

Lifestyle4 weeks agoBrits Identify Adulting Challenges: Cleaning, Cooking, and Time Woes