Entertainment

Martin Lewis Presses Chancellor on Pension Changes and Tax Relief

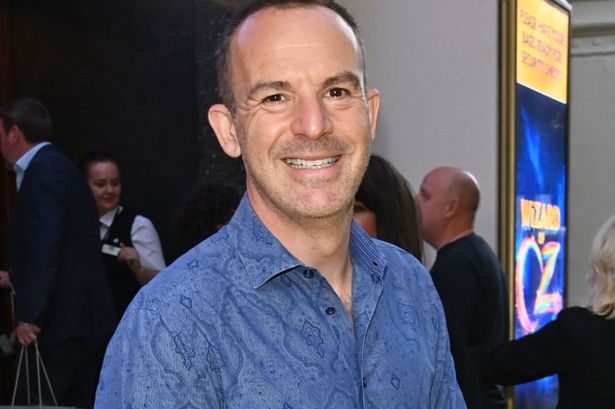

Financial expert Martin Lewis recently engaged in a critical discussion with UK Chancellor Rachel Reeves concerning significant changes announced in the latest Budget. This conversation primarily addressed concerns surrounding the state pension and its implications for low-income retirees.

In the Budget, Reeves confirmed that the new full state pension will increase by 4.8 percent starting in April, raising it to £12,548 annually. While this adjustment offers some relief, it has sparked anxiety among pensioners, as it approaches the standard personal allowance of £12,570. Individuals earning above this threshold are required to start paying income tax, leading to fears that pensioners with additional income could inadvertently exceed this limit.

Tax Relief for State Pension Recipients

During his appearance on the ITV show, Lewis successfully secured a commitment from Reeves that should alleviate these concerns. The Chancellor assured viewers that those whose only income is the state pension will not be obligated to file a tax return. She stated, “If you just have a state pension and you don’t have any other pension, we are not going to make you fill in a tax return. I make that commitment for this parliament. They won’t have to pay the tax.”

Reeves further emphasized that the government aims to avoid pursuing “tiny amounts of money” from low-income pensioners. This clarification has been welcomed by Lewis, who advocates for a more straightforward approach to tax obligations for retirees.

Despite this positive development, Lewis expressed his discontent regarding the government’s decision to reduce the tax-free cash ISA limit from £20,000 to £12,000 starting in April 2027. This change will not affect individuals aged 65 and over. The Labour government argues that this measure is intended to encourage savers to invest in stocks and shares ISAs, benefiting UK-listed companies.

Lewis countered this rationale, stating, “I think this is the wrong way to do it. There are other ways to encourage people to invest instead.” In response, Reeves noted that “ninety percent of people with savings will still have no tax on their savings” and highlighted ongoing changes in advice and guidance rules to support investors.

Addressing Energy Costs and Fixed Tariffs

In addition to discussing pensions, Lewis provided insights on energy prices following Reeves’ announcement of measures designed to reduce household bills by an average of £150. This reduction will be achieved by eliminating two charges previously added to energy bills, including a discredited home insulation scheme.

While Lewis welcomed the initiative, he suggested a more equitable approach. “I would have preferred it to have come off the standard charge then everyone gets the same reduction,” he noted, underscoring the importance of ensuring that all households benefit from the relief.

He also urged those on standard tariffs to consider switching to fixed-rate deals, advising, “I would absolutely not be waiting; I would be getting a good saving now.” With concerns that the proposed £150 savings might not extend to individuals on fixed deals, Lewis consulted Ed Miliband, the Energy Secretary. Miliband assured viewers that discussions with energy companies are underway to ensure that benefits are passed on to all consumers, including those on fixed rates.

The dialogue between Lewis and Reeves highlights ongoing challenges within the UK regarding pension policies and energy costs. As the government navigates these issues, the clarity provided by the Chancellor should help ease the financial burdens faced by low-income pensioners while also addressing broader economic concerns.

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Health4 months ago

Health4 months agoCarol Vorderman Reflects on Health Scare and Family Support

-

Entertainment4 months ago

Entertainment4 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

World2 weeks ago

World2 weeks agoBailey Announces Heartbreaking Split from Rebecca After Reunion

-

Entertainment3 months ago

Entertainment3 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend

-

Entertainment2 weeks ago

Entertainment2 weeks agoCoronation Street Fans React as Todd Faces Heartbreaking Choice