Business

Millions Eligible for £1,200 Bonuses Through Help to Save Scheme

The UK’s HM Revenue and Customs (HMRC) has announced that approximately 7.5 million people receiving Universal Credit are eligible for a potential cash boost of up to £1,200. This initiative is part of the Help to Save scheme, which incentivizes savings by providing a government-backed bonus for eligible individuals.

The Help to Save accounts allow participants to save between £1 and £50 each month, with the government adding 50p for every £1 saved over a four-year period. The announcement comes as the number of individuals receiving Universal Credit rose from 6.4 million in January 2024 to 7.5 million in August 2025, highlighting the growing reliance on state support amid economic challenges.

Details of the Help to Save Scheme

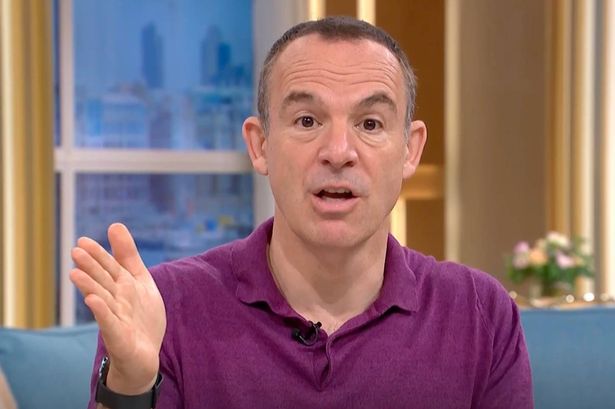

Introduced in September 2018, the Help to Save scheme is designed to encourage savings among those on low incomes. The program, endorsed by financial expert Martin Lewis, allows participants to accumulate savings while receiving a substantial bonus from the government.

Savers can deposit funds into their accounts via debit card, standing order, or bank transfer. There are no restrictions on the number of contributions each month, provided the total does not exceed £50. Additionally, participants are not obligated to make monthly contributions, offering flexibility in managing personal finances.

According to HMRC, bonuses are awarded at the end of the second and fourth years based on the highest balance achieved. For example, if an individual saves the maximum of £50 each month for two years, they could earn up to £300 as a bonus, effectively doubling their savings.

The final bonus calculation takes into account the difference between the peak balance in the first two years and that in the last two years. If the highest balance remains unchanged, no final bonus will be awarded. This structure encourages continuous saving and financial resilience among participants.

Impact and Encouragement to Participate

Since its launch, nearly 500,000 savers have taken advantage of the Help to Save scheme, collectively depositing £372.5 million into their accounts. Myrtle Lloyd, HMRC’s Director General for Customer Services, emphasized the benefits of the program, stating, “Hundreds of thousands of people are benefitting from Help to Save. It’s a great way of saving whatever you can, and the government will top up your savings by 50%.”

Lewis, the founder of Money Saving Expert, has publicly praised the Help to Save scheme, labeling it “unbeatable.” He encourages individuals on Universal Credit to explore this opportunity, highlighting the potential for significant savings without risk. “If you’re eligible for it, you can put up to £50 a month in over two years, and then at the end, you get 50% of the highest amount in,” he explained.

For those interested in applying, the process is straightforward. Individuals can visit the official government website or use the HMRC app to access the Help to Save scheme. This initiative not only aims to bolster individual savings but also serves as a crucial tool for enhancing financial stability in challenging times.

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health2 months ago

Health2 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment2 months ago

Entertainment2 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science4 weeks ago

Science4 weeks agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Entertainment4 months ago

Entertainment4 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment2 months ago

Entertainment2 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend

-

Entertainment3 months ago

Entertainment3 months agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment4 months ago

Entertainment4 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

World2 months ago

World2 months agoCole Palmer’s Mysterious Message to Kobbie Mainoo Sparks Speculation