Politics

UK State Pension Age May Rise to 70 as Triple Lock Faces Scrutiny

The UK’s state pension age could potentially rise to 70, as discussions around the sustainability of the triple lock policy intensify. Experts are urging Chancellor Rachel Reeves to reconsider this policy amid growing financial pressures on the nation. Currently, the state pension age is set at 66, with plans to increase it to 67 by 2028. Additional increases are anticipated in the coming decades.

Financial advisers and think tanks are advocating for a more immediate response to demographic shifts and rising costs that threaten the long-term viability of the pension system. Speaking to Newspage, independent financial adviser Samuel Mather-Holgate highlighted the urgent need for reform: “The state pension system is ripe for squeezing, so an increase to the state pension age is coming down the tracks, probably to 70.” He added that altering the triple lock could yield significant savings, but acknowledged the political challenges given the voting power of older generations.

The current pension framework already accounts for nearly 5% of the UK’s GDP, a figure projected to reach almost 8% within the next 50 years. The Office for Budget Responsibility (OBR) warned that expenses related to pensions will exceed previous forecasts by £10 billion annually, primarily due to unpredictable inflation and sluggish wage growth since 2012.

The triple lock guarantees that pensions increase each year by the highest of inflation, earnings growth, or 2.5%. Critics identify it as a major factor contributing to rising expenditures, estimating that it could add an additional £23 billion to annual pension costs by 2030 compared to an inflation-only increase.

Organizations such as the Institute for Fiscal Studies are advocating for a more gradual approach to pension reform. They propose that the state pension age should rise in line with life expectancy while ensuring workers receive ample notice before any changes take effect. Their recommendations include phasing out the triple lock once a sustainable replacement rate is established, in favor of a more consistent pension uprating system.

Economists have voiced support for revising the triple lock, arguing that the current trajectory is unsustainable. Economist Ben Ramanauskas expressed on social media platform X, “Triple Lock needs to be replaced with a single lock indexing the State Pension to average earnings growth. It will be far more sustainable and give pensioners more of a stake in productivity gains.”

Despite these calls for reform, the Government has reaffirmed its commitment to the existing policy until the end of the parliamentary session. A Treasury spokesperson stated, “We are committed to supporting pensioners and giving them the dignity and security they deserve in retirement.” A comprehensive review of the state pension age is scheduled for publication in 2027, which may provide further clarity on future changes.

-

Entertainment2 weeks ago

Entertainment2 weeks agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment2 weeks ago

Entertainment2 weeks agoLas Culturistas Awards Shine with Iconic Moments and Star Power

-

Entertainment2 weeks ago

Entertainment2 weeks agoMarkiplier Addresses AI Controversy During Livestream Response

-

Politics1 month ago

Politics1 month agoPlane Crash at Southend Airport Claims Four Lives After Takeoff

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoTesco Slashes Prices on Viral Dresses in Summer Clearance Sale

-

Science3 weeks ago

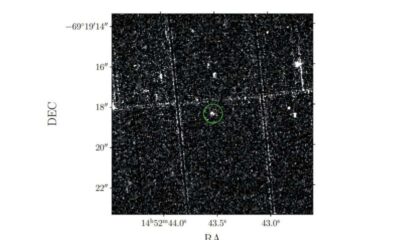

Science3 weeks agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Health2 weeks ago

Health2 weeks agoWakefield’s Top 13 GP Practices Revealed in 2025 Patient Survey

-

Sports2 weeks ago

Sports2 weeks agoCommunity Pays Tribute as Footballer Aaron Moffett Dies at 38

-

Top Stories1 month ago

Top Stories1 month agoAustralian Man Arrested for Alleged Damage to Stone of Destiny

-

Sports1 month ago

Sports1 month agoSheffield United’s Young Talent Embraces Championship Opportunity

-

Business1 month ago

Business1 month agoNew Study Links Economic Inequality to Lower Well-Being Globally