Business

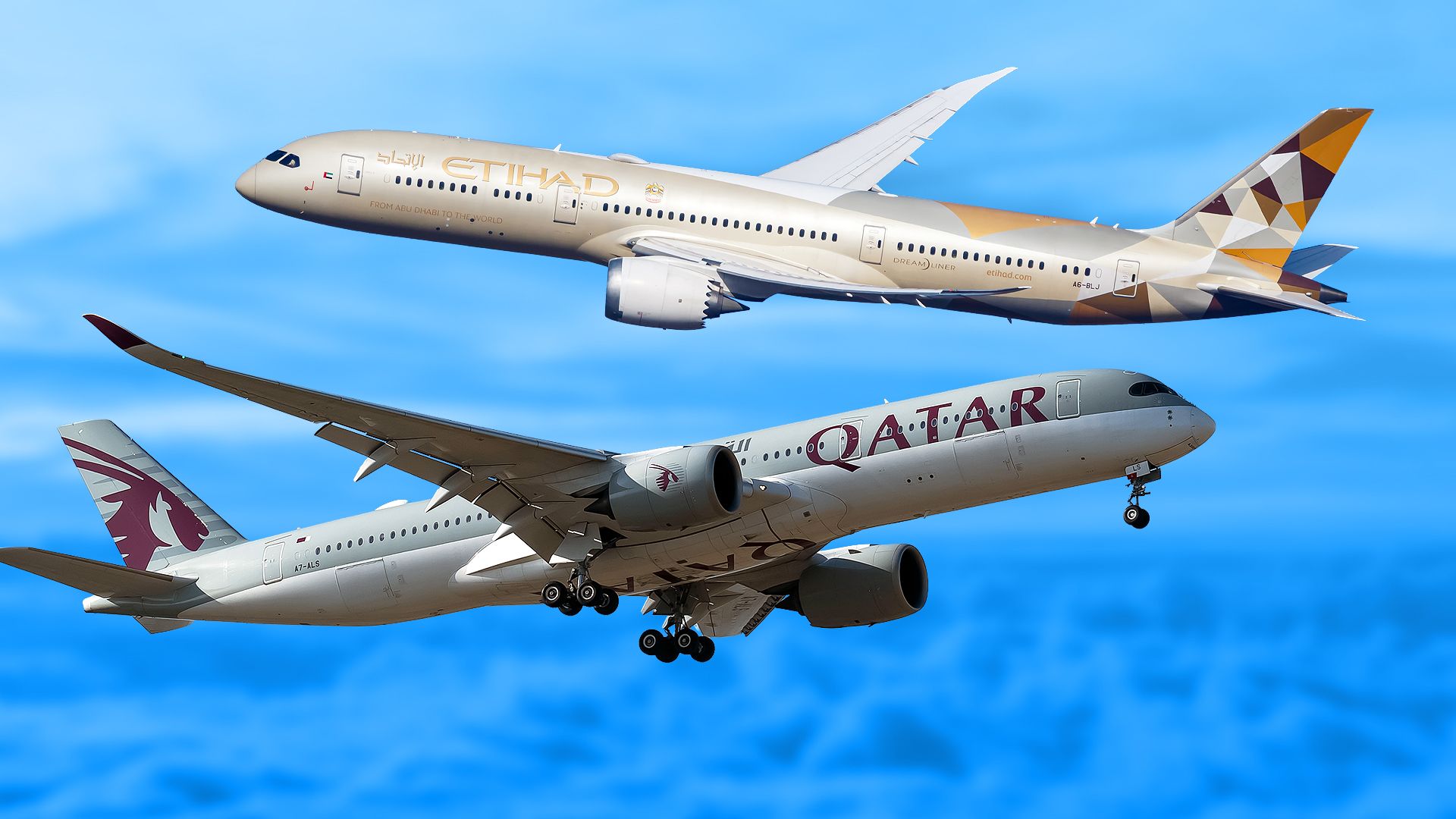

Emirates, Etihad, and Qatar Airways: A Fleet Showdown

The competition among major airlines in the Middle East is intensifying, with Emirates, Etihad Airways, and Qatar Airways vying for dominance in the region. Each carrier has established itself as a key player, operating extensive networks supported by large fleets of widebody aircraft. This article examines the fleet sizes and compositions of these three airlines to determine which one holds the largest operational capacity.

Emirates: The Fleet Leader

Emirates, founded in 1985, has grown to become the largest airline in the Middle East, operating out of Dubai International Airport. The airline’s fleet is relatively straightforward, consisting of three primary aircraft families: the A350, the A380, and the Boeing 777. As of now, Emirates maintains an active fleet of 275 aircraft, including 118 Airbus A380s and 119 Boeing 777-300ERs.

The airline has ordered additional models, including the Boeing 777-8 and 777-9, aimed at further expanding its operations. Notably, Emirates boasts the largest twin-aisle fleet globally, a factor that has played a crucial role in its rise as one of the top airlines in terms of passenger numbers. Excluding its wet-leased Boeing 747s, Emirates operates 269 aircraft, comprising 257 passenger planes and 11 cargo planes.

Qatar Airways: A Competitive Force

Founded in 1994, Qatar Airways operates its hub at Doha Hamad International Airport. The airline’s fleet is slightly more diverse than Emirates’, incorporating narrowbody aircraft alongside its widebody models. Currently, Qatar Airways operates 270 aircraft, including a mix of Airbus A330s, A350s, and the Boeing 777 series.

Qatar Airways has a notable freight division, operating 28 Boeing 777 Freighters compared to Emirates’ 11. While its fleet size is comparable to Emirates when excluding certain aircraft, Qatar’s focus on cargo operations sets it apart. Its passenger fleet consists of 242 planes, slightly fewer than Emirates’ 257.

Etihad Airways: The Smaller Contender

Etihad Airways, the youngest of the three, launched in 2003 and is based at Abu Dhabi Zayed International Airport. The airline has faced challenges in recent years, leading to a reduction in its fleet size, which currently stands at 118 aircraft. This includes a mix of narrowbody and widebody aircraft, with a significant focus on the Boeing 787 Dreamliner.

Despite its smaller size, Etihad has ambitions to grow its fleet and passenger numbers significantly by 2030. The airline aims to double its fleet while ensuring that growth remains profitable and sustainable. Etihad’s efforts to rebrand itself as a boutique premium carrier following significant financial setbacks illustrate its commitment to recovery and strategic growth.

Conclusion: A Landscape of Competition

In summary, Emirates leads the pack with its extensive fleet and strong market presence, operating 275 aircraft. Qatar Airways follows closely with a fleet of 270 aircraft, benefiting from a robust cargo division. Meanwhile, Etihad, with its 118 aircraft, is working to redefine its position in the competitive landscape of Middle Eastern aviation.

As these airlines continue to innovate and expand, their strategies will impact not only their operational capacities but also the broader aviation market, making this rivalry one to watch in the coming years. Each airline’s unique approach to fleet management and service offerings highlights the dynamic nature of the aviation industry in the Middle East.

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Entertainment4 months ago

Entertainment4 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment2 months ago

Entertainment2 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend

-

Entertainment3 months ago

Entertainment3 months agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment4 months ago

Entertainment4 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

World3 months ago

World3 months agoCole Palmer’s Mysterious Message to Kobbie Mainoo Sparks Speculation