Business

Citi Executive Deletes Controversial Gaza Post After Backlash

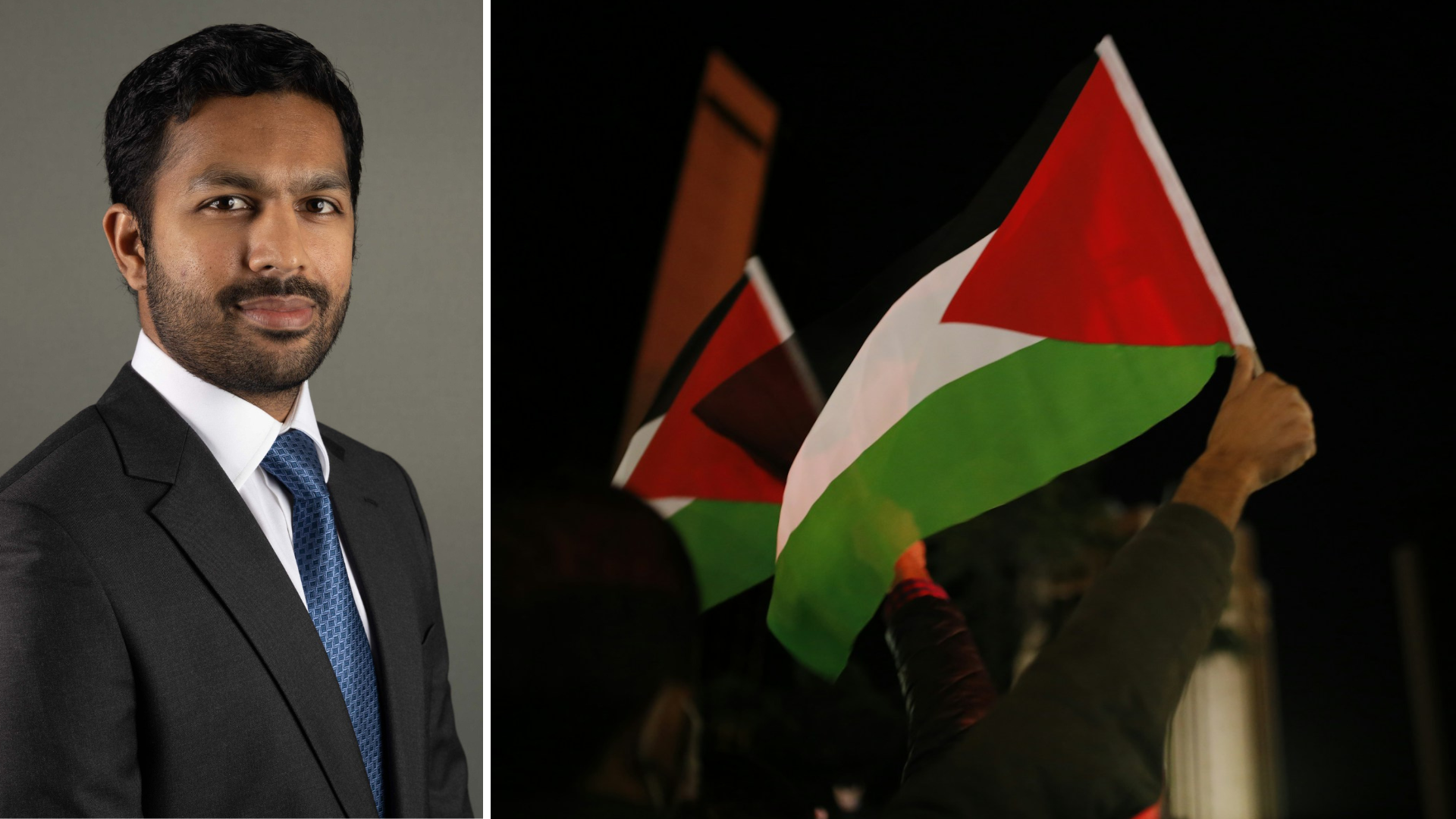

A senior executive at Citigroup has come under scrutiny for a LinkedIn post addressing the humanitarian crisis in Gaza. Akshay Singal, the global head of short-term interest rate (STIRT) trading, expressed his disapproval of Israel’s actions in the region, sharing images of malnourished children. Following significant corporate pressure, Singal deleted the post.

In his original message, Singal stated, “Until now, I’ve kept most of my thoughts to private channels. But that’s not enough. What’s happening demands our attention, and our voice.” He characterized the situation in Gaza as “horrific and unacceptable,” labeling it a genocide, and concluded with a striking assertion: “Silence isn’t neutrality. It’s complicity.” Interestingly, Singal is currently on a six-month paternity leave, during which he has emphasized the importance of being present for his family.

Concerns regarding the appropriateness of Singal’s comments have been raised by former colleagues. One remarked, “Really dumb. Have your views for sure, but don’t publish with Citi’s name on your profile,” especially given his paid leave status. Citigroup confirmed that they had requested Singal to remove the post, noting that it was “inconsistent with our code of conduct.” A spokesperson for the bank added that the matter is under review.

The controversy highlights the complex dynamics between corporate policies and employee activism. Many companies, particularly in the financial sector, have opted to avoid taking public stances on sensitive political issues, especially those related to Israel and Palestine. This hesitance is influenced by the strong backing of Israel from political figures, including former President Donald Trump, which has led to fears of backlash against businesses that openly support one side.

Critics of Citigroup have pointed out the bank’s financial ties to Israel. According to Visualising Palestine, Citigroup holds stakes in Israeli banks such as Bank Leumi and Israel Discount Bank and is involved in financing arrangements that support Israel’s military operations.

The situation also reflects a broader trend among U.S. companies, where employees expressing solidarity with Palestinians have faced disciplinary actions. For instance, a registered nurse in California was terminated by UnitedHealth Group after displaying pro-Palestinian stickers, leading her to pursue legal action for alleged viewpoint discrimination. Additionally, employees at Microsoft were dismissed for protesting the company’s contracts with Israel’s military during high-profile events.

Similar patterns have emerged at companies like Google and Meta, where employees who voiced pro-Palestinian sentiments have reported facing discrimination or termination. These cases underscore the delicate balancing act companies face in navigating employee expression while maintaining corporate reputations.

As the situation in Gaza continues to evolve, the tension between personal beliefs and professional responsibilities remains a critical topic for discussion within corporate environments. The implications of Singal’s deleted post may resonate beyond Citigroup, prompting broader conversations about corporate accountability and employee rights in the context of global conflicts.

-

World1 day ago

World1 day agoCoronation Street’s Shocking Murder Twist Reveals Family Secrets

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 weeks ago

Entertainment3 weeks agoCoronation Street Fans React as Todd Faces Heartbreaking Choice

-

World3 weeks ago

World3 weeks agoBailey Announces Heartbreaking Split from Rebecca After Reunion

-

World4 days ago

World4 days agoKevin Sinfield Exceeds Fundraising Goal Ahead of Final Marathons

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment4 days ago

Entertainment4 days agoTwo Stars Evicted from I’m A Celebrity Just Days Before Finale

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science2 months ago

Science2 months agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery