Business

CIBC Innovation Banking Secures £60 Million for Smart’s Growth

CIBC Innovation Banking has announced its role as the lead arranger and agent for a substantial £60 million credit facility granted to Smart, a fintech company based in London. This significant funding will support Smart’s ongoing growth initiatives and enable the company to capitalize on opportunities within the rapidly consolidating UK market.

Smart is recognized as a global provider of savings and investments technology, facilitating seamless enrollment for employers and efficient management of retirement savings for employees. Its flagship product, Keystone, is a cloud-native workplace retirement savings platform that has gained traction across multiple countries. Additionally, Smart oversees one of the UK’s largest auto-enrolment master trusts, the Smart Pension Master Trust, which currently supports over 1.5 million savers and more than 90,000 employers.

Funding to Drive Innovation and Growth

In a statement regarding the funding, Eoin Corcoran, Chief Financial Officer of Smart, expressed enthusiasm for the company’s accomplishments in recent years. He noted the importance of reaching profitability and highlighted CIBC’s role in supporting Smart’s journey since 2022. Corcoran stated, “We are delighted with the growth we’ve achieved alongside the important milestone of becoming a profitable business. CIBC Innovation Banking has been an important part of our journey since 2022 and their ongoing support will enable us to continue developing innovative solutions to help employees around the world save more effectively for retirement.”

The funding will also position Smart to take advantage of evolving market dynamics as the UK’s retirement savings sector undergoes significant consolidation.

Commitment to Transformation in Retirement Savings

Sean Duffy, Managing Director and European Market Lead at CIBC Innovation Banking, commented on Smart’s potential for success. He remarked, “Smart’s modern technology, coupled with sector expertise, is the factor for its success to date in the retirement and pension industry. We are thrilled to continue supporting the Smart team on its mission to help transform retirement, savings and financial well-being for employees, employers, financial institutions, and governments globally.”

The partnership between CIBC Innovation Banking and Smart signifies a commitment to innovation in the financial technology sector, particularly in solutions that enhance retirement savings. As the demand for effective retirement solutions grows, both companies are poised to play a pivotal role in shaping the future of financial well-being for a global workforce.

-

Entertainment2 weeks ago

Entertainment2 weeks agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment4 weeks ago

Entertainment4 weeks agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 week ago

Entertainment1 week agoLas Culturistas Awards Shine with Iconic Moments and Star Power

-

Entertainment2 weeks ago

Entertainment2 weeks agoMarkiplier Addresses AI Controversy During Livestream Response

-

Politics1 month ago

Politics1 month agoPlane Crash at Southend Airport Claims Four Lives After Takeoff

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoTesco Slashes Prices on Viral Dresses in Summer Clearance Sale

-

Top Stories1 month ago

Top Stories1 month agoAustralian Man Arrested for Alleged Damage to Stone of Destiny

-

Sports2 weeks ago

Sports2 weeks agoCommunity Pays Tribute as Footballer Aaron Moffett Dies at 38

-

Science2 weeks ago

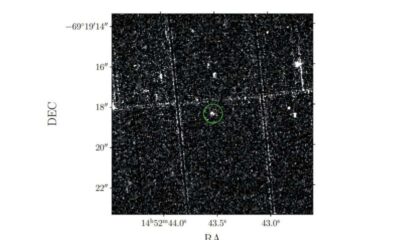

Science2 weeks agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Sports1 month ago

Sports1 month agoSheffield United’s Young Talent Embraces Championship Opportunity

-

Business1 month ago

Business1 month agoNew Study Links Economic Inequality to Lower Well-Being Globally

-

Entertainment2 weeks ago

Entertainment2 weeks agoEmmerdale Characters Face Danger as Stabbing Shakes Village