Business

AIB, PTSB, and Bank of Ireland Unveil Zippay Mobile Payment Service

A partnership between AIB, PTSB, and Bank of Ireland is set to introduce a new mobile payment service called Zippay, which aims to compete with established platforms like Revolut. The launch is expected in March 2026 and will initially cater to the banks’ five million eligible customers.

Zippay will be seamlessly integrated within the existing mobile banking applications of the three institutions. This feature aims to provide users with a familiar and secure environment for transactions. The service will be powered by the European payment technology firm Nexi, which has established itself in various markets and has previously collaborated with several Irish financial entities.

Through Zippay, users will have the ability to send and request money, as well as split bills with individuals who are also registered on the platform. According to Brian Hayes, the CEO of Banking and Payments Federation Ireland (BPFI), the service’s connection to existing banking apps ensures a high level of security and protection. He noted that there will be no need to set up new payees or input IBAN or BIC numbers, simplifying the transaction process.

The payment limits for Zippay will allow customers to transfer up to €1,000 per day and request up to €500 per transaction. This flexibility is expected to facilitate everyday transactions in a user-friendly manner.

Renato Martini, the Digital Banking Solutions Director for the Nexi Group, emphasized the scalable design of Zippay. Built on an API-based architecture, the platform is prepared for future expansions, with the aim of making the service available to a broader range of financial institutions operating in Ireland. After its initial rollout, Nexi plans to welcome all financial entities offering IBAN accounts and mobile apps to join Zippay, thereby enhancing accessibility for Irish consumers.

The initiative to create a mobile payment solution was first announced in 2022 under the name Synch Payments. However, those plans were ultimately abandoned due to various challenges. Initial delays in the project timeline, complications with competition clearance from the Competition and Consumer Protection Commission, and requirements from the Central Bank of Ireland for additional authorizations contributed to the decision to halt the earlier effort.

Despite the setbacks, the launch of Zippay signifies a renewed commitment from AIB, PTSB, and Bank of Ireland to innovate within the digital payment landscape. The financial institutions aim to accelerate the adoption of mobile payment solutions across Ireland, enhancing the overall consumer experience.

As the digital payment ecosystem continues to evolve, the introduction of Zippay may well position these traditional banks as competitive players in a market increasingly dominated by fintech solutions. The overarching goal remains to streamline transactions and improve accessibility for consumers in an ever-changing financial environment.

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment2 weeks ago

Entertainment2 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment1 month ago

Entertainment1 month agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

Science1 month ago

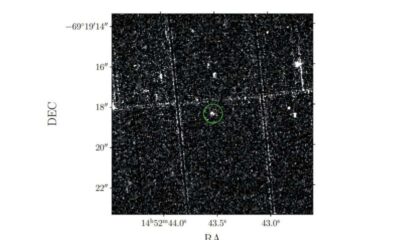

Science1 month agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Entertainment1 month ago

Entertainment1 month agoLas Culturistas Awards Shine with Iconic Moments and Star Power

-

Entertainment1 week ago

Entertainment1 week agoKatie Price Celebrates Surprise Number One Hit with Family Support

-

Entertainment3 weeks ago

Entertainment3 weeks agoTurmoil in Emmerdale: Charity Dingle and Mack’s Relationship at Risk