Top Stories

UK Life Sciences Sector Plan Sparks Mixed Reactions from CEOs

The UK Government unveiled its latest Life Sciences Sector Plan on July 16, 2025, aiming to foster innovation and improve health outcomes. Despite the ambitious goals outlined, industry leaders express skepticism, citing a history of similar initiatives that have yet to deliver substantial change.

Mikkel Kristiansen, CEO of VentriJect, voiced his concerns regarding the Plan, describing it as a reiteration of past strategies. The document promotes faster clinical trials, enhanced foreign direct investment (FDI), and improved patient access to new technologies. While these objectives sound appealing, Kristiansen notes, “Readers will be forgiven for thinking we’ve heard all this before.”

In previous years, initiatives such as the Life Sciences Industrial Strategy of 2017, various Life Sciences Sector Deals, and the MedTech Strategy of 2023 have introduced similar themes without significant follow-through. This pattern raises questions about the UK’s commitment to genuinely transforming its healthcare landscape.

For many companies, including VentriJect, the critical issue is not merely the existence of plans but the practical implications for market access and technology adoption. Kristiansen emphasized the need for streamlined pathways to ensure that innovative technologies reach patients promptly. The introduction of an ‘Innovator Passport’ is a promising concept, yet he points out a lack of clarity on how small to medium-sized enterprises (SMEs) will navigate the complexities of local market connections.

The National Health Service (NHS) presents a unique paradox. As a major healthcare provider, it has the potential to deliver new medical technologies to millions. Nonetheless, its reputation for slow and inconsistent technology adoption continues to frustrate innovators. Kristiansen remarked that many companies have become cautious about the government’s bold proclamations, now preferring to monitor on-the-ground developments.

Another notable aspect of the Sector Plan is the anticipated establishment of a Health Data Research Service (HDRS). For data-driven companies like VentriJect, which offers a device that measures VO2 max—a crucial indicator of cardiorespiratory health—this could provide significant opportunities. By integrating their data with genomic and clinical insights, they envision delivering a comprehensive view of individual health. Yet, Kristiansen questions how the plan will resolve privacy and security concerns that could hinder effective data utilization.

In contrast, Denmark’s Strategy for Life Science towards 2030 stands out for its actionable focus and clear objectives. The Danish government aims to double exports by 2030, a goal that has already yielded tangible benefits for VentriJect through state-sponsored market visits to regions like California and Texas. Kristiansen highlights Denmark’s strong ecosystem for life sciences, noting that venture investments in life science companies per million inhabitants were 56 in Denmark from 2021 to 2023 compared to 41 in the UK.

Germany is also taking steps to enhance its life sciences landscape with the establishment of a federal ministry for digitalization and government modernization. This initiative aims to bolster telemedicine and create a more favorable regulatory environment for MedTech companies, particularly those focused on data and artificial intelligence.

The United States offers a different landscape, one that VentriJect is currently exploring. Although its fragmented healthcare system can be challenging, the size of the market, rapid adoption rates, and significant capital pools present compelling opportunities for health tech companies. Kristiansen notes that U.S. healthcare providers often respond more swiftly to market dynamics than to federal policy, which can be advantageous for agile SMEs.

Despite continuing to export to the UK, Kristiansen believes that being based in Denmark provides a broader perspective on the international context. While the UK remains recognized for its research and innovation, its commercial potential appears less enticing in the short term compared to countries like Denmark and Germany.

The success of the UK’s latest Life Sciences Sector Plan hinges on its ability to facilitate rapid adoption of innovations within the NHS. Until tangible actions are taken to ensure that patients benefit promptly from new technologies, many startups will continue to question whether the UK is the right locale for their innovations. As Kristiansen aptly states, “Where can we see our innovation getting to patients quickly? The UK is not yet a convincing answer.”

-

Entertainment2 weeks ago

Entertainment2 weeks agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 weeks ago

Entertainment3 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment1 week ago

Entertainment1 week agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment2 weeks ago

Entertainment2 weeks agoITV’s I Fought the Law: Unraveling the True Story Behind the Drama

-

Entertainment1 month ago

Entertainment1 month agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Lifestyle4 weeks ago

Lifestyle4 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

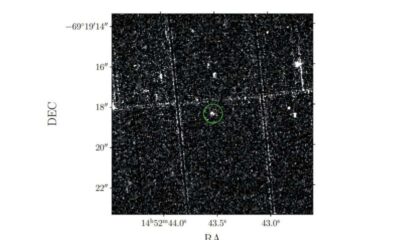

Science2 months ago

Science2 months agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore