Business

Reeves Restricts Treasury Reserve Access Ahead of Upcoming Budget

Rachel Reeves, the Chancellor of the Exchequer, has announced significant restrictions on government departments’ access to the Treasury’s emergency funds. This decision comes as the Labour Party prepares for its upcoming budget presentation on November 26, 2023. The move aims to tighten departmental spending and ensure fiscal responsibility as pressures mount to stimulate economic growth while adhering to borrowing limits.

The Treasury Reserve, amounting to £9 billion, is intended for “genuinely unforeseen, unaffordable and unavoidable pressures.” However, it has recently been tapped to cover increased public sector pay and compensation payouts. In a letter addressed to ministers, Reeves stated that the Treasury would only consider allocating reserve funds to departments that have already maximized their savings.

Focus on Fiscal Discipline and Growth

With less than 11 weeks until the budget announcement, Reeves is under pressure to outline her strategy for enhancing economic growth while keeping public finances in check. The Chancellor emphasized that limiting access to reserve funds is crucial for maintaining her borrowing rules, which aim to reduce government borrowing. She highlighted the importance of sticking to the spending totals set during the June Spending Review.

In her cabinet briefing, Reeves warned that any funds borrowed from the reserve would need to be repaid. She reiterated her commitment to ensuring that day-to-day government expenses are funded through tax revenue rather than borrowing by the fiscal year 2029-30. This approach reflects her goal of decreasing debt as a proportion of national income by the conclusion of this parliamentary term.

Reeves conveyed to her colleagues that the upcoming Autumn focus would be on “reducing inflation, controlling spending, and kickstarting growth.” She expressed concern about the fragility of bond markets in many advanced economies, asserting that “stability is more important than ever to underpin growth in a volatile global environment.” She stated that maintaining fiscal discipline means “living within our means.”

Market Reactions and Future Challenges

The Chancellor’s remarks were not only directed at her cabinet but also aimed at reassuring financial markets and Labour backbench MPs. In the House of Commons, she urged her colleagues to resist the urge to avoid difficult spending decisions. Her message comes in the context of the recent Spending Review, which reduced the Treasury Reserve from its usual level of approximately £14 billion per year. The Institute for Fiscal Studies has pointed out that this reduction leaves little room to address unforeseen financial challenges.

Estimates regarding the funding Reeves needs to identify to meet her self-imposed borrowing criteria vary significantly. Some projections suggest a requirement of around £25 billion, while the National Institute of Economic and Social Research estimates it could be as high as £50 billion. In a recent BBC interview, Reeves sought to downplay the latter figure, emphasizing her intention to “get the balance right” in the forthcoming budget.

Reeves has established two non-negotiable rules regarding government borrowing: ensuring that day-to-day operating costs are covered by tax income rather than borrowing, and achieving a reduction in debt relative to national income by the end of this parliamentary session.

Rain Newton-Smith, head of the Confederation of British Industry, commented on the Chancellor’s fiscal approach, calling for a commitment to tax reform rather than merely raising taxes. She noted that businesses have been under pressure following increased employer National Insurance contributions and the National Living Wage, compounded by ongoing price hikes. Newton-Smith stated, “The Chancellor cannot raid corporate coffers again; she must look elsewhere, embracing long-term strategic tax reforms.”

As the budget date approaches, Reeves faces the dual challenge of addressing immediate economic concerns while adhering to her fiscal principles, a balancing act that will be closely scrutinized by both Parliament and the markets.

-

Entertainment1 month ago

Entertainment1 month agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment1 month ago

Entertainment1 month agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Entertainment3 weeks ago

Entertainment3 weeks agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment1 week ago

Entertainment1 week agoITV’s I Fought the Law: Unraveling the True Story Behind the Drama

-

Entertainment1 month ago

Entertainment1 month agoAldi Launches Cozy Autumn Fragrance Range Ahead of Halloween

-

Entertainment2 months ago

Entertainment2 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

Entertainment1 month ago

Entertainment1 month agoMarkiplier Addresses AI Controversy During Livestream Response

-

Health1 month ago

Health1 month agoWigan and Leigh Hospice Launches Major Charity Superstore

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoSummer Flags Spark Controversy Across England as Patriotism Divides

-

Science1 month ago

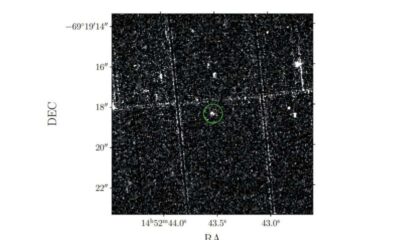

Science1 month agoAstronomers Unveil New Long-Period Radio Transient ASKAP J1448−6856

-

Entertainment1 month ago

Entertainment1 month agoLas Culturistas Awards Shine with Iconic Moments and Star Power

-

Entertainment1 week ago

Entertainment1 week agoKatie Price Celebrates Surprise Number One Hit with Family Support