Business

Tax Thresholds Frozen: Middle-Income Households Bear the Burden

The upcoming Budget is set to disproportionately impact middle-income households, as the government considers freezing income tax thresholds. According to John O’Connell, chief executive of the Taxpayers’ Alliance, this decision will further squeeze those earning between £45,000 and £46,000 annually, leaving them vulnerable amidst rising living costs.

The proposed definition of a “working person” by the government draws attention to the financial pressures faced by many. If the earning threshold is set at £45,000, it implies that individuals above this line can shoulder more of the financial burden, a notion that O’Connell challenges. He points out that many who earn just over this threshold, including senior paramedics, headteachers, and software developers, do not feel wealthy. These professionals are grappling with escalating rents, mortgage payments, and childcare costs, all while contributing significantly to the nation’s tax revenue.

If tax thresholds are frozen, O’Connell argues, then any automatic increases in benefits should also be reconsidered. The rationale is straightforward: if there is no capacity to alleviate the financial strain on taxpayers, there should not be an expectation for increased spending on welfare.

Impact of Frozen Tax Thresholds

The government’s approach to tax thresholds is raising concerns among economists and citizens alike. The Office for Budget Responsibility (OBR) estimates that freezing personal allowances and basic-rate bands could result in an additional four million people entering the income tax system by 2028. This scenario is exacerbated by inflation; as wages rise, more individuals find themselves paying higher taxes without an increase in their real income.

This phenomenon, often referred to as a “stealth tax,” disproportionately affects middle-income families. As their nominal pay increases, the lack of corresponding adjustments in tax thresholds means they feel increasingly financially constrained.

Despite the tightening fiscal environment, speculation is growing around potential new spending commitments, such as the scrapping of the two-child benefit cap. This raises questions about the government’s priorities. If public finances are indeed so strained that tax thresholds cannot be adjusted, O’Connell asks why funds would be available for increasing welfare expenditures.

Consistency in Fiscal Policy

A fundamental principle in fiscal policy is consistency. If the government is serious about maintaining the freeze on tax thresholds, it should apply the same logic to spending. O’Connell asserts that the moment tax thresholds are adjusted upwards, that should also signal a time to review benefit increases.

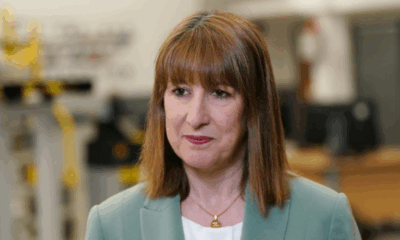

The ongoing discussions surrounding potential income tax rises and the implications of frozen thresholds contribute to the perception that middle-income households are seen as an easy target for revenue generation. Rachel Reeves, a prominent figure in the Labour Party, has emphasized the importance of fiscal credibility. However, O’Connell argues that credibility is built on sound decisions, not slogans. He warns that the government risks undermining its claims of responsibility by proposing new spending commitments while maintaining that it cannot afford to raise tax thresholds.

The Chancellor faces a significant challenge: to demonstrate fiscal discipline while being transparent about the consequences of frozen tax thresholds. O’Connell concludes that these frozen thresholds effectively act as tax increases, and new spending should be viewed as a discretionary choice. Middle-income earners, who play a vital role in sustaining the economy, should not be treated as a default source of revenue for government spending.

-

Entertainment2 months ago

Entertainment2 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment3 months ago

Entertainment3 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health2 months ago

Health2 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment2 months ago

Entertainment2 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment2 months ago

Entertainment2 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

Entertainment3 months ago

Entertainment3 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Science4 weeks ago

Science4 weeks agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Entertainment2 months ago

Entertainment2 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend

-

Entertainment3 months ago

Entertainment3 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Entertainment3 months ago

Entertainment3 months agoMasterChef Faces Turmoil as Tom Kerridge Withdraws from Hosting Role

-

Entertainment4 months ago

Entertainment4 months agoSpeculation Surrounds Home and Away as Cast Departures Mount

-

World2 months ago

World2 months agoCole Palmer’s Mysterious Message to Kobbie Mainoo Sparks Speculation