Business

Mastercard’s Laura Quevedo Addresses AI-Driven Fraud Solutions

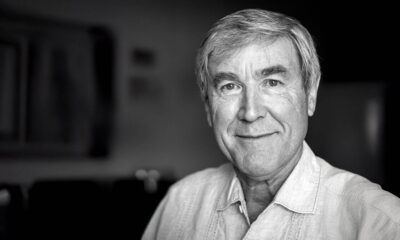

The rise of AI-generated fraud threats has prompted calls for enhanced security measures in the digital landscape. During the recent RiskX event held in Rome, Laura Quevedo, Executive Vice President of Fraud and Decisioning Solutions at Mastercard, discussed the challenges posed by these sophisticated fraud tactics and the potential of artificial intelligence in combating them.

In her address, Quevedo highlighted the need for organizations to adopt smarter solutions for fraud prevention. She noted that as fraud methods evolve, so must the approaches to counteract them. The increasing complexity of digital transactions necessitates a deeper understanding of transaction data, enabling businesses to better detect and respond to fraudulent activities.

Adapting to Evolving Threats

According to Quevedo, the sophistication of modern fraud threats has outpaced traditional security measures. AI technologies can analyze vast amounts of data in real time, identifying patterns and anomalies that human analysts might miss. This capability is crucial for organizations striving to stay ahead of fraudsters who are leveraging similar technologies to devise new schemes.

Quevedo emphasized that for AI to be effective in fraud prevention, organizations must improve the granularity of the data they collect. Detailed transaction information is essential to accurately assess risks and distinguish between legitimate and fraudulent activities. She stated, “Organizations need to harness the power of AI and combine it with comprehensive transaction insights to develop robust defenses against fraud.”

The conversation at the RiskX event underscored the urgency for businesses to re-evaluate their fraud prevention strategies. With data breaches and financial losses on the rise, the implementation of advanced AI-driven solutions is no longer optional but a necessity.

The Role of Collaboration

Quevedo also pointed out that collaboration among industry players is vital in the fight against fraud. Sharing information about emerging threats and effective countermeasures can significantly enhance the collective ability to combat fraud. Mastercard, in its role, is committed to fostering partnerships that promote a collaborative approach to security.

In conclusion, as the digital world continues to evolve, so too must the strategies employed to protect it. The insights shared by Laura Quevedo at the RiskX event illuminate the path forward, urging organizations to invest in sophisticated AI tools and comprehensive data analytics. By doing so, they can not only safeguard their assets but also build trust with their customers in an increasingly challenging environment.

-

Entertainment3 months ago

Entertainment3 months agoAnn Ming Reflects on ITV’s ‘I Fought the Law’ Drama

-

Entertainment4 months ago

Entertainment4 months agoKate Garraway Sells £2 Million Home Amid Financial Struggles

-

Health3 months ago

Health3 months agoKatie Price Faces New Health Concerns After Cancer Symptoms Resurface

-

Entertainment3 months ago

Entertainment3 months agoCoronation Street’s Carl Webster Faces Trouble with New Affairs

-

Entertainment3 months ago

Entertainment3 months agoWhere is Tinder Swindler Simon Leviev? Latest Updates Revealed

-

World2 weeks ago

World2 weeks agoBailey Announces Heartbreaking Split from Rebecca After Reunion

-

Entertainment2 weeks ago

Entertainment2 weeks agoCoronation Street Fans React as Todd Faces Heartbreaking Choice

-

Entertainment4 months ago

Entertainment4 months agoMarkiplier Addresses AI Controversy During Livestream Response

-

Science1 month ago

Science1 month agoBrian Cox Addresses Claims of Alien Probe in 3I/ATLAS Discovery

-

Health5 months ago

Health5 months agoCarol Vorderman Reflects on Health Scare and Family Support

-

Entertainment4 months ago

Entertainment4 months agoKim Cattrall Posts Cryptic Message After HBO’s Sequel Cancellation

-

Entertainment3 months ago

Entertainment3 months agoOlivia Attwood Opens Up About Fallout with Former Best Friend